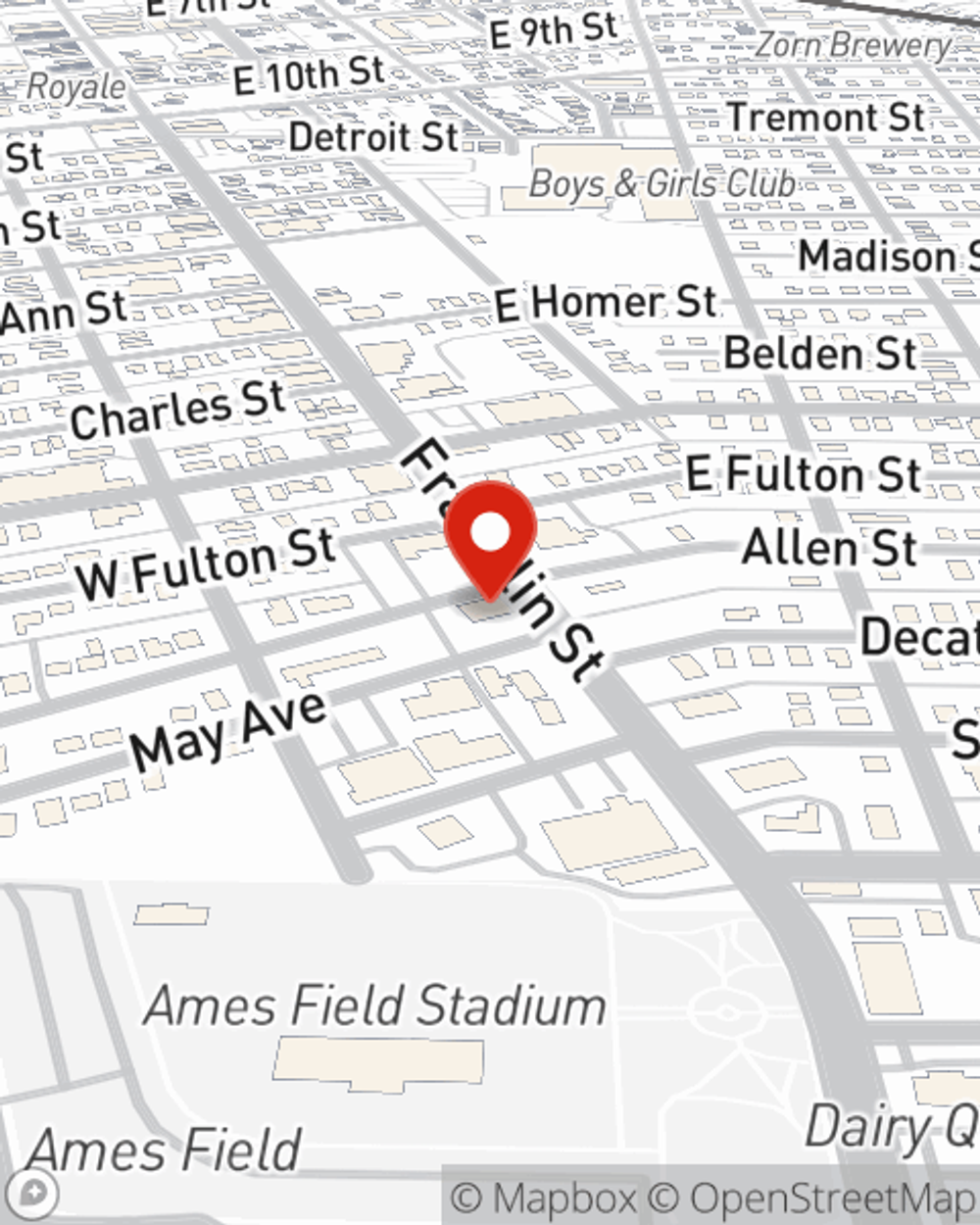

Business Insurance in and around Michigan City

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

- Michigan City

- LaPorte

- Valparaiso

- Chesterton

- Westville

- Rolling Meadows

- Burns Harbor

- Merrillville

- Miller Beach

- Mill Creek

- Westfield

- South Bend

- New Buffalo

- Three Oaks

- Union Pier

- Lakeside

- Buchanan

- Niles

- Laporte County

- Porter County

Help Prepare Your Business For The Unexpected.

Small business owners like you have a lot of responsibility. From HR supervisor to inventory manager, you do everything you can each day to make your business a success. Are you an optometrist, a real estate agent or a pet groomer? Do you own a bridal shop, a pet store or a refreshment stand? Whatever you do, State Farm may have small business insurance to cover it.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Get Down To Business With State Farm

You are dedicated to your small business like State Farm is dedicated to great insurance. That's why it only makes sense to check out their coverage offerings for worker’s compensation, commercial auto or surety and fidelity bonds.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Connie Patricks is here to help you identify your options. Reach out today!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Connie Patricks

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.