Life Insurance in and around Michigan City

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Michigan City

- LaPorte

- Valparaiso

- Chesterton

- Westville

- Rolling Meadows

- Burns Harbor

- Merrillville

- Miller Beach

- Mill Creek

- Westfield

- South Bend

- New Buffalo

- Three Oaks

- Union Pier

- Lakeside

- Buchanan

- Niles

- Laporte County

- Porter County

It's Never Too Soon For Life Insurance

Buying life insurance coverage can be a lot to consider with various options out there, but with State Farm, you can be sure to receive caring dependable service. State Farm understands that your purpose is to help provide for your partner.

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Michigan City Chooses Life Insurance From State Farm

When it comes to picking how much coverage you need, State Farm can help. Agent Connie Patricks can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include how old you are, your physical health, and sometimes even occupation. By being aware of these elements, your agent can help make sure that you get a personalized policy for you and your loved ones based on your specific situation and needs.

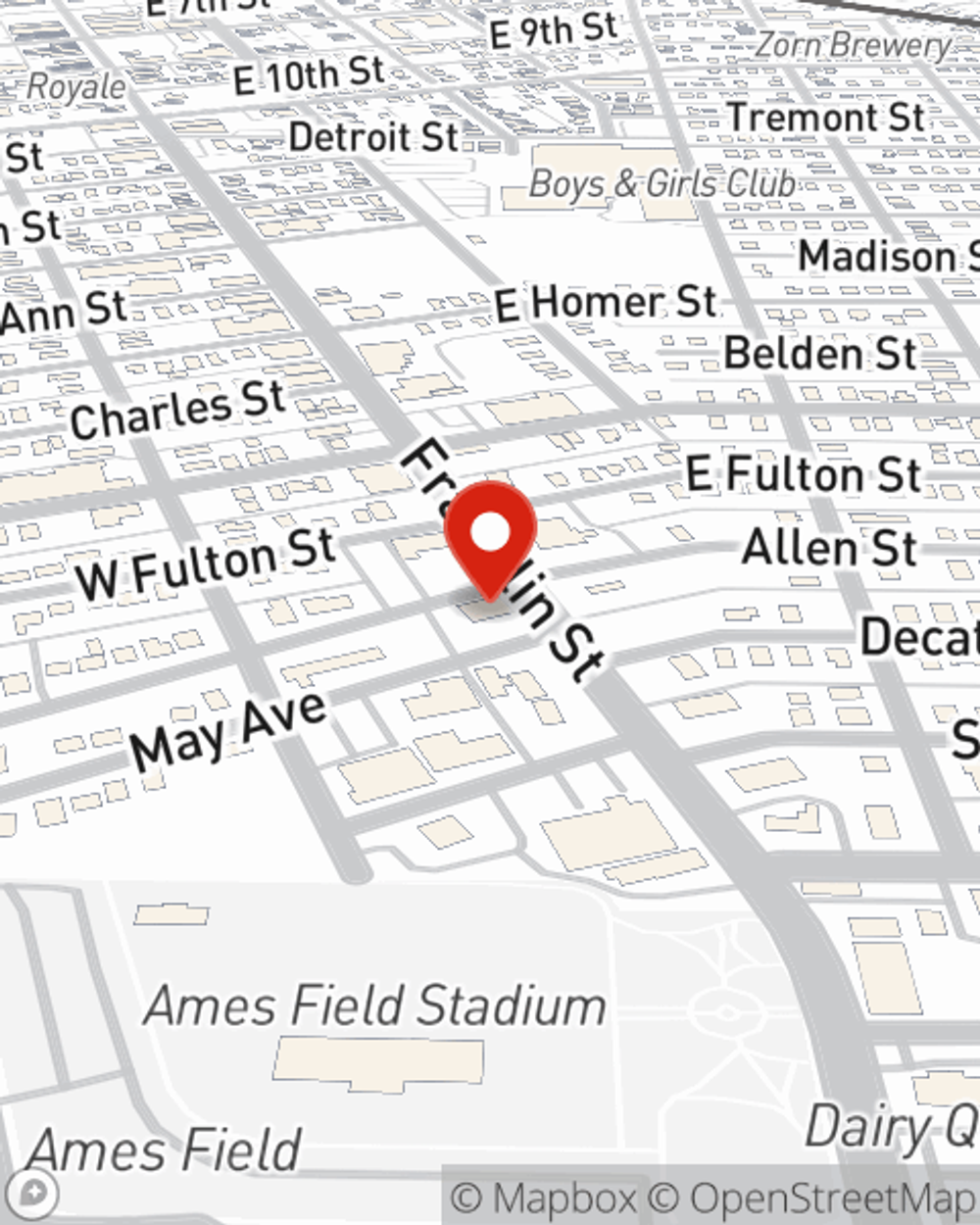

Visit State Farm Agent Connie Patricks today to find out how a State Farm policy can protect your loved ones here in Michigan City, IN.

Have More Questions About Life Insurance?

Call Connie at (219) 879-4408 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Connie Patricks

State Farm® Insurance AgentSimple Insights®

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.